Old Reports -> Debtor -> Statements

|

|

Bug - Vat Number It is recommended that the following Debtor statements is printed in the Reports → Debtors → Outstanding menu: 1.Debtor statements - Prints all transactions whether transactions are linked or not linked in Open item link. 2.Debtor statements – Outstanding - Supports the Open item processing feature. Prints only the outstanding transactions or transactions not paid in full. Transactions, which are fully settled and linked, will not be printed. |

|

|

Bug - Vat Number The printed Debtor statements displays the Vat Number (Edit → Debtors) in the footer section. This label is not translatable and the Vat tax terminology is not applicable to all countries (tax regimes). |

|

|

Bug - Vat amounts incorrect on outstanding amount of a partial payment on an Invoice The printed Debtor statements displays the Vat Number (Edit → Debtors) in the footer section. This label is not translatable and the Vat tax terminology is not applicable to all countries (tax regimes). |

Introduction

This option allows you to generate statements which you wish to dispatch to your debtors to inform them of the amounts they owe you. Before you send statements to your debtors it is important to check whether you have entered and posted all the transactions for your debtors to the ledger.

The Debtor statements will display the transactions entered and posted in batches (Sales journal, Sales Returns Journal, Receipts journal, etc.). If you are trading in Stock items it will also display the transactions for Invoices and Credit notes which are updated to the ledger. If you are using the Point-of Sale facility only the Point-of Sale Invoices for Shifts, which have been closed, will be included in this report.

The Debtor statements needs to be generated at least monthly and sent to the debtors. This will remind the debtors to pay or settle their account. Some debtors may wish to reconcile your creditor account (in the debtor's books) with their accounting records. You may also receive Remittance advises from your debtors which you may reconcile with the statements or your Debtor's ledger.

To Print Debtor statements:

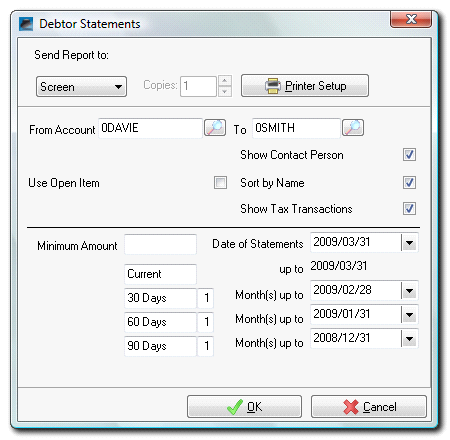

1.Click on the Tools → Old Reports → Debtors → Statements menu. The Debtor statements Options screen is displayed:

2.Send report to - Select the output method (screen, printer, file, e-mail or fax).

3.Select the following options:

a)From account ... To - You may select all your debtors, a specific debtor, or a specified range of debtors, to be included in this report.

b)Use open item - If this box is ticked, the open item method will be displayed.

c)Show Contactperson - The details of the contact person will be displayed if this field is selected.

d)Sort by name - If this box is ticked, the debtors will be listed in alphabetical order. If not selected, the debtors will be listed in the account code sequence.

e)Show Tax Transactions - If this box is ticked, all transactions will be displayed exclusive of VAT/GST/Sales tax. The Tax transactions relating to VAT/GST/Sales tax will be displayed separately in a blue colour.

f)Minimum amount - You may wish to exclude debtors who owe less than a specified amount. Enter the minimum amount you do not wish to follow up. This is a very handy facility, if you wish to target debtors with a minimum outstanding amount, not exceeding the specified amount. An amount you specify may not be economically recoverable or you wish to target outstanding debtors from a specified amount to minimise your losses or improve your cash flow.

g)Terms - You may specify any suitable description to meet your specific requirements for the current and three ageing terms. The normal recommended circumstances would be to include the periods as defined in your credit terms, current, 30, 60 and over 90 days. Note that if your trading terms are 30 days, periods 60 and 90 should be classified as Overdue.

h)Date of Statement - You may specify the date of the statements. This date will include transactions on or before this date.

i)Up to - The months up to will specify the date in which the transactions for the current period should be included.

j)Months up to - The months up to may be selected, as to report the age analysis on, but could include any period specified.

4.Click on the OK button. The Statements will be sent to the medium selected in the "Send report to" field.

View Debtor statements

An example of a Debtors Statement, which include Tax Transactions, is as follows:

The Statement displays the information in the following four (4) basic sections:

1.Header section - Contains the name of your business, the postal address which was entered on the Edit → Debtors (Accounting information tab) for the debtor (customer / client), the Debtor (customer / client) account number or code, date of the statement and the number of pages.

2.Transaction section - Contains the details of the transactions as entered and posted to the ledger in batches and invoices and credit notes, which have been updated to the ledger (if you are trading in stock items).

For batches (journals) it would display: the date of the transaction, reference number (deposit number, etc.), the description as entered in the description field of the batches (journals) and a debit or credit amount. Any sales journal transactions for sales, should display the amounts in the Debit column. Any sales returns entered in the Sales or Sales Returns Journal and receipts entered in the Receipts journal, should display the transaction amounts in the Credit column.

In the case of documents (Invoices and Credit notes documents), the document date and document number as generated by TurboCASH4 is displayed. The Description will display the Document type as either an Invoice or a Credit note and any references, if entered in the "Your reference" field on the Document entry (Header) screen. Any Invoice document transactions for sales, should display the amounts in the Debit column. Any Credit note document transactions, should display the transaction amounts in the Credit column.

These amounts would be displayed as Inclusive of VAT/GST/Sales tax, unless the Show Tax Transaction option is selected. If the Show Tax Transactions option is selected, the transaction amounts would be displayed as Exclusive of VAT/GST/Sales tax and the Output VAT/GST/Sales tax transaction and amount will be displayed separately in a blue colour directly underneath the transaction.

3.Ageing section - The Carried forward balance (closing balance) at the end or last day of the selected date (which was selected to include transactions up to), will display the outstanding closing balance at the end of each of the specified ageing periods. The default descriptions (Current, 30 Days, 60 Days and 90 Days) will be displayed with your own descriptions, if you have entered your own on the Debtor Statement options screen.

4.Footer section - Contains company address and telephone number as entered on the Setup → System parameters → Company info (Address tab) menu. It will also display the debtor (customer / client) account, date of the statement and the contact person, if selected.